- Memecoins like $MELANIA highlight a unique digital sub-culture within cryptocurrencies, blending whimsy with financial opportunity.

- The $MELANIA token launched shortly after the $TRUMP token, quickly skyrocketing from a low initial price to enormous gains thanks to investor timing and strategy.

- Despite being technically similar to traditional cryptocurrencies, memecoins embrace volatility and defy conventional financial logic.

- Early investors can potentially gain explosive profits, driven by a speculative environment where timing and calculated risks are key.

- The rapid launch and sale process of memecoins present ethical and regulatory challenges, with a lack of transparency raising questions of fairness.

- These ventures intertwine with trust and timing, reflecting the unpredictable and risky landscape of modern financial speculation.

- The memecoin phenomenon mirrors a quest for value and illustrates the fine line between digital innovation and speculative frenzy.

Beneath the frenetic digital world of cryptocurrencies lies a peculiar sub-culture: memecoins. These whimsical yet lucrative financial instruments continually redefine our understanding of money, the market, and, sometimes, the modern-day treasure hunt—all exemplified by the meteoric rise of the $MELANIA token. Not long ago, a startling sequence of events unfolded with surgical preciseness, transforming “get-rich-quick” from a hopeful mantra to a tangible reality.

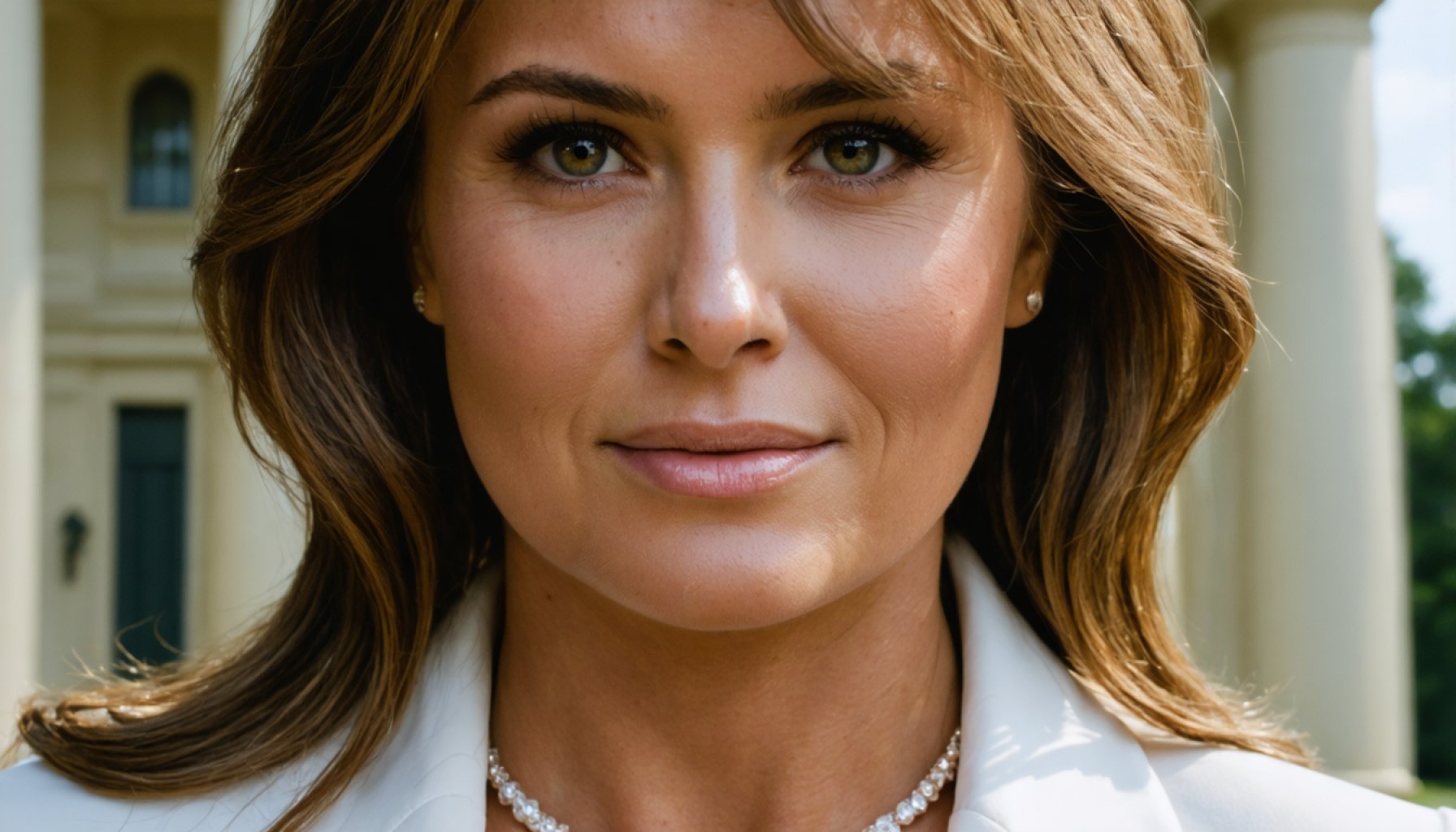

Initially priced near zero, $MELANIA launched just 43 hours after the announcement of the $TRUMP token, orchestrated by former first lady Melania Trump. The revelation sent ripples through digital currencies, leaving many to wrangle with questions of legitimacy, insider knowledge, and financial ethics. Despite being in an ecosystem where regulative shadows linger, a cadre of savvy investors unearthed an unimaginable opportunity. They executed lightning-fast transactions, purchasing $2.6 million worth of the token only to resell it days later for an eye-popping $100 million. Their secret? Timing, calculated risks, and the nebulous allure of memecoins.

Indistinguishable from their conventional cryptocurrency cousins in technicality, memecoins defy traditional financial logic by embracing volatility and ambiguity. The law of multiples allows early investors to achieve explosive gains—a tantalizing prospect absent in the more structured IPO realm. One astonishing example involved a buyer who catapulted their investment from a meager $0.13 per coin to an average selling price of $8.34—all by getting in before the presale buzz. Unlike the anticipated predictability of share launches, memecoins manifest as an untamed wilderness.

These ventures depend heavily on the intricate web of trust and timing. Where $TRUMP’s arrival followed a meticulously laid plan, $MELANIA’s launch was the wild west of high-stakes speculation. It was crafted and deployed in a rip-roaring rush, with tokens minted a mere 78 minutes before becoming public. The website domain was acquired with equal haste, emblematic of the hurried—and arguably hazardous—rush to market.

Yet, while some might see memecoins as a leisure pursuit of financial high-jinks, the underlying currents reveal stark ethical dilemmas. The opaque nature of memecoin launches effectively fabricates a veil where anonymity meets opportunity, posing a challenging scenario for both governance and fair play. In the case of $TRUMP, measures were in place to prevent pre-launch sales—a nod to conventional market norms. However, the opacity surrounding these ventures conjures persistent ethical questions, especially when they swivel near global leaders, as influence can seamlessly intertwine with investor intent.

The narrative of $MELANIA is less a tale of innovation and more a chronicle of fervent participation in a boundless digital dream. These modern-day El Dorados, painted with digital brushstrokes, unmask a basic truth: in the world of memecoins, informed intuition and nimble operations elevate some into a pantheon of fiscal fortune, while others watch from the fringes, trying to decode a world where truth and meme are often indistinguishable.

The enthralling escapades of these coins come with an unspoken takeaway: the intricate dance of risk and reward remains as beguiling as the coins themselves, highlighting a frontier where calculated moves spell out fortunes amidst market enigmas.

The memecoin saga underscores our endless quest for value—transforming digital whimsy into potent fiscal fables, one coin at a time.

The Memecoin Phenomenon: Unpacking the Hype and Reality Behind $MELANIA and $TRUMP Tokens

Understanding Memecoins: A Deep Dive

Memecoins, a sub-category of cryptocurrencies, have captured the public’s imagination with their quirky names and astronomical gain potential. Unlike traditional cryptocurrencies like Bitcoin or Ethereum, memecoins often derive their value and popularity from internet culture, memes, and well-timed social media campaigns.

Real-World Use Cases:

1. Community Engagement: Memecoins foster online communities that thrive on humor and shared goals, making them popular for social platforms.

2. Speculative Trading: Investors often buy memecoins for quick profits due to their volatile nature, as evidenced by the $MELANIA case.

3. Philanthropy and Charitable Causes: Some memecoins initiate or support charitable initiatives, leveraging community engagement for positive impact.

Market Trends and Forecasts

The memecoin market is characterized by rapid shifts and trends often influenced by social media trends and celebrity endorsements. Analysts suggest that the memecoin phenomenon is not a temporary trend but rather an ongoing segment in the broader crypto market. According to CoinMarketCap, the value of memecoins can see explosive growth, akin to past instances like Dogecoin’s rise.

Ethical Considerations

1. Transparency Issues: The opacity and anonymity in memecoin launches lead to ethical questions concerning fairness and regulation.

2. Potential for Manipulation: The involvement of high-profile figures like Melania Trump can intertwine influence with investor intent, raising concerns about insider trading and market manipulation.

Pros and Cons Overview

Pros:

– Potential for high returns on investment.

– Encourages creative and community-driven initiatives.

– Offers diversification in a crypto portfolio.

Cons:

– High risk and volatility.

– Lack of regulation and market manipulation potential.

– Ethical concerns with transparency.

Security and Sustainability

While blockchain technology inherently provides a degree of security, the fast-paced nature of memecoin launches can sometimes overlook security protocols, making them susceptible to scams and “rug pulls.” Investing in memecoins requires due diligence and skepticism.

Top Tips for Navigating Memecoin Investments:

1. Stay Informed: Use platforms like CoinMarketCap for research and trend tracking.

2. Diversify Investments: Do not rely solely on memecoins; diversify your portfolio to mitigate risks.

3. Engage with Communities: Join online forums or social media groups to stay informed about upcoming launches and market sentiment.

4. Exercise Caution: Be wary of memecoins with little information or those heavily pushed by influencers without clear backing.

Conclusion

Memecoins like $MELANIA and $TRUMP showcase the dual nature of financial innovation and ethical dilemmas in the crypto space. While they offer tantalizing opportunities for wealth creation, they also highlight the need for prudent investment strategies and ethical considerations. By staying informed and exercising caution, investors can navigate this volatile market landscape more confidently.